Категории

-

Коврики в салон и багажник

- ACURA (Акура)

- ALFA ROMEO (Альфа Ромео)

- AUDI (Ауди)

- AVIA (Авиа)

- BAIC (Баик)

- BAW (Бау)

- BMW (БМВ)

- BRILLIANCE (Брилиянс)

- BYD (Бюд)

- CADILLAC (Кадиллак)

- CHANGAN (Чанган)

- CHERY (Чери)

- CHEVROLET (Шевроле)

- CHRYSLER (Крайслер)

- CITROEN (Ситроен)

- DAIHATSU (Дайхатсу)

- DATSUN (Датсун)

- DFM (ДФМ)

- DODGE (Додж)

- DONGFENG

- EVOLUTE (Эволют)

- FAW (Фав)

- FIAT (Фиат)

- FORD (Форд)

- FOTON (Фотон)

- GEELY (Джили)

- GREAT WALL (Грейт Вол)

- HAFEI (Хафей)

- HAIMA (Хайма)

- HAVAL (Хавал)

- HAWTAI (Хавтай)

- HINO (Хино)

- HONDA (Хонда)

- HONGQI (Хунци)

- HUMMER (Хаммер)

- HYUNDAI (Хендай)

- INFINITI (Инфинити)

- ISUZU (Исузу)

- JAC

- JAGUAR (Ягуар)

- JEEP (Джип)

- KAIYI (Каи)

- KHODRO (Ходро)

- KIA (Киа)

- LADA (Лада)

- LAND ROVER (Ленд Ровер)

- LEXUS (Лексус)

- LI AUTO

- LIFAN (Лифан)

- LUXGEN

- MAZDA (Мазда)

- MERCEDES BENZ (Мерседес Бенц)

- MINI (Мини)

- MITSUBISHI (Мицубиси)

- NISSAN (Ниссан)

- OMODA (ОМОДА)

- OPEL (Опель)

- PEUGEOT (Пежо)

- PORSCHE (Порше)

- RAVON/DAEWOO

- RENAULT (Рено)

- SAAB (Сааб)

- SEAT (Сеат)

- SKODA (Шкода)

- SOKON (Сокон)

- SOLLERS (Соллерс)

- SSANGYONG (Санг Йонг)

- SUBARU (Субару)

- SUZUKI (Сузуки)

- Tank

- TATA (Тата)

- TOYOTA (Тойота)

- VOLKSWAGEN (Фольксваген)

- VOLVO (Вольво)

- YUEJIN (Юджин)

- ZAZ (ЗАЗ)

- ZOTYE

- ГАЗ (GAZ)

- МАЗ (MAZ)

- МАН

- ТАГАЗ (TAGAZ)

- УАЗ (UAZ)

- Коврики в салон универсальные

-

Автобагажники

- ALFA ROMEO (Альфа Ромео)

- AUDI (Ауди)

- BMW (БМВ)

- CADILLAC (Кадиллак)

- CHEVROLET (Шевроле)

- CHRYSLER (Крайслер)

- CITROEN (Ситроен)

- DACIA (Дачия)

- Daewoo (Дэу)

- FIAT (Фиат)

- FORD (Форд)

- HONDA (Хонда)

- HYUNDAI (Хендай)

- INNOCENTI (Инноченти)

- IVECO (Ивеко)

- KIA (Киа)

- LAND ROVER (Ленд Ровер)

- LEXUS (Лексус)

- MAZDA (Мазда)

- MERCEDES BENZ (Мерседес Бенц)

- MIni(Мини)

- MITSUBISHI (Мицубиси)

- NISSAN (Ниссан)

- OPEL (Опель)

- PEUGEOT (Пежо)

- RENAULT (Рено)

- ROVER (Ровер)

- Saab(Сааб)

- SEAT (Сеат)

- SKODA (Шкода)

- SSANGYONG (Санг Йонг)

- Subaru (Субару)

- SUZUKI (Сузуки)

- TATA (Тата)

- TOYOTA (Тойота)

- VOLKSWAGEN (Фольксваген)

- VOLVO (Вольво)

- Боксы на крышу

- Велобагажники

- Лыжное крепление

- Аксессуары для салона и багажника

-

Аксессуары для внешнего тюнинга

- AUDI (Ауди)

- CADILLAC (Кадиллак)

- CHERY (Чери)

- CHEVROLET (Шевроле)

- CHRYSLER (Крайслер)

- CITROEN (Ситроен)

- DACIA (Дация)

- DODGE (Додж)

- FIAT (Фиат)

- FORD (Форд)

- GREAT WALL (Грейт Вол)

- HONDA (Хонда)

- HUMMER (Хаммер)

- HYUNDAI (Хендай)

- INFINITI (Инфинити)

- ISUZU (Исузу)

- JEEP (Джип)

- KIA (Киа)

- LADA (Лада)

- LAND ROVER (Ленд Ровер)

- LEXUS (Лексус)

- MAZDA (Мазда)

- MERCEDES BENZ (Мерседес Бенц)

- MITSUBISHI (Мицубиси)

- NISSAN (Ниссан)

- OPEL (Опель)

- PEUGEOT (Пежо)

- RENAULT (Рено)

- SSANGYONG (Санг Йонг)

- SUBARU (Субару)

- SUZUKI (Сузуки)

- TAGER (ТагАЗ Тагер)

- TOYOTA (Тойота)

- VOLKSWAGEN (Фольксваген)

- VOLVO (Вольво)

- ZX AUTO (Зет Икс Авто)

- на передние окна

- УАЗ (UAZ)

-

Брызговики

- AUDI

- BAIC (Баик)

- BRILLIANCE

- CADILLAC (Кадиллак)

- CHANGAN (Чанган)

- CHERY (Чери)

- CHEVROLET (Шевроле)

- CHRYSLER (Крайслер)

- CITROEN (Ситроен)

- DONGFENG

- EVOLUTE

- EXEED

- FAW (Фав)

- FIAT (Фиат)

- FORD (Форд)

- GAC

- GEELY (Джили)

- GREAT WALL (Грейт Вол)

- HAIMA

- HAVAL (Хавал)

- HAWTAI

- HONDA (Хонда)

- HYUNDAI (Хендай)

- JAC

- JEEP (Джип)

- JETOUR

- JETTA

- KAIYI (Каи)

- KIA (Киа)

- LADA (Лада)

- LIFAN (Лифан)

- LIVAN (Ливан)

- LUXGEN

- MAZDA (Мазда)

- MERCEDES BENZ (Мерседес Бенц)

- MITSUBISHI (Мицубиси)

- NISSAN (Ниссан)

- OMODA

- OPEL (Опель)

- PEUGEOT (Пежо)

- RAVON

- RENAULT (Рено)

- SKODA (Шкода)

- SSANGYONG (Санг Йонг)

- SUBARU (Субару)

- SUZUKI (Сузуки)

- TOYOTA (Тойота)

- VOLKSWAGEN (Фольксваген)

- VOLVO (Вольво)

- WEY

- ZOTYE

- МОСКВИЧ 3

- Универсальные

-

Дворники

- ACURA (Акура)

- ALFA ROMEO (Альфа Ромео)

- AUDI (Ауди)

- BMW (БМВ)

- BRILLIANCE (Брилиянс)

- BYD (Бюд)

- CADILLAC (Кадиллак)

- CHERY (Чери)

- CHEVROLET (Шевроле)

- CHRYSLER (Крайслер)

- CITROEN (Ситроен)

- DAEWOO (Дэу)

- DAIHATSU (Дайхатсу)

- DATSUN (Датсун)

- DODGE (Додж)

- FAW (Фав)

- FIAT (Фиат)

- FORD (Форд)

- GEELY (Джили)

- GREAT WALL (Грейт Вол)

- HONDA (Хонда)

- HUMMER (Хаммер)

- HYUNDAI (Хендай)

- INFINITI (Инфинити)

- ISUZU (Исузу)

- JAGUAR (Ягуар)

- JEEP (Джип)

- KIA (Киа)

- LADA (Лада)

- LAND ROVER (Ленд Ровер)

- LEXUS (Лексус)

- LIFAN (Лифан)

- MAZDA (Мазда)

- MERCEDES BENZ (Мерседес Бенц)

- MINI (Мини)

- MITSUBISHI (Мицубиси)

- NISSAN (Ниссан)

- OPEL (Опель)

- PEUGEOT (Пежо)

- PORSCHE (Порше)

- RENAULT (Рено)

- SAAB (Сааб)

- SEAT (Сеат)

- SKODA (Шкода)

- SSANGYONG (Санг Йонг)

- SUBARU (Субару)

- SUZUKI (Сузуки)

- TOYOTA (Тойота)

- VOLKSWAGEN (Фольксваген)

- VOLVO (Вольво)

- ZAZ (ЗАЗ)

- ГАЗ (GAZ)

- ТАГАЗ (TAGAZ)

-

Дефлекторы

- AUDI (Ауди)

- BAIC (Баик)

- BMW (БМВ)

- BRILLIANCE

- BYD

- CHANGAN

- CHERY (Чери)

- CHEVROLET (Шевроле)

- CITROEN (Ситроен)

- DAF

- DATSUN (Датсун)

- DODGE (Додж)

- DONGFENG

- EVOLUTE

- EXEED

- FAW (Фав)

- FIAT (Фиат)

- FORD (Форд)

- FOTON

- FREIGHTLINER

- GAC

- GEELY

- GREAT WALL (Грейт Вол)

- HAVAL (Хавал)

- HAWTAI (Хавтай)

- HINO

- HONDA (Хонда)

- HUMMER (Хаммер)

- HYUNDAI (Хендай)

- INFINITI (Инфинити)

- ISUZU

- IVECO

- JAC

- JAGUAR

- JEEP (Джип)

- JETOUR

- KAIYI (Каи)

- KENWORTH

- KHODRO (Ходро)

- KIA (Киа)

- LADA (ЛАДА)

- LAND ROVER

- LEXUS (Лексус)

- LIFAN

- LIVAN (Ливан)

- MAN

- MAZDA (Мазда)

- MERCEDES BENZ

- MITSUBISHI (Мицубиси)

- NISSAN (Ниссан)

- OMODA (Омода)

- OPEL (Опель)

- PETERBILT

- PEUGEOT (Пежо)

- PORSCHE

- RAVON/DAEWOO

- RENAULT (Рено)

- SAAB (Сааб)

- SCANIA

- SHACMAN

- SKODA (Шкода)

- SOLLERS (Соллерс)

- SSANGYONG (Санг Йонг)

- SUBARU (Субару)

- SUZUKI (Сузуки)

- TAGAZ

- TANK (Танк)

- TOYOTA (Тойота)

- VOLKSWAGEN (Фольксваген)

- VOLVO (Вольво)

- ZOTYE

- ГАЗ (GAZ)

- ЗАЗ (ZAZ)

- ЗИЛ

- ИЖ

- КАМАЗ

- МАЗ (MAZ)

- Москвич

- УАЗ

- Универсальные

-

Защита картера

- AVIA (Авиа)

- BAW (Бау)

- BMW (БМВ)

- BYD (Бюд)

- CADILLAC (Кадиллак)

- CHERY (Чери)

- CHEVROLET (Шевроле)

- CITROEN (Ситроен)

- DAEWOO (Дэу)

- FIAT (Фиат)

- FORD (Форд)

- GEELY (Джили)

- GREAT WALL (Грейт Вол)

- HONDA (Хонда)

- Hover (Ховер)

- HYUNDAI (Хендай)

- INFINITI (Инфинити)

- JEEP (Джип)

- KHORDO (Кодро)

- KIA (Киа)

- LEXUS (Лексус)

- LIFAN (Лифан)

- MAZDA (Мазда)

- MITSUBISHI (Мицубиси)

- NISSAN (Ниссан)

- OPEL (Опель)

- PEUGEOT (Пежо)

- RENAULT (Рено)

- SKODA (Шкода)

- SOKON (Сокон)

- SSANGYONG (Санг Йонг)

- SUBARU (Субару)

- SUZUKI (Сузуки)

- TOYOTA (Тойота)

- VOLKSWAGEN (Фольксваген)

- VOLVO (Вольво)

- ZAZ (ЗАЗ)

- ВАЗ (VAZ)

- ГАЗ (GAZ)

- ТАГАЗ (TAGAZ)

-

Подкрылки

- ACURA (Акура)

- AUDI (Ауди)

- BMW (БМВ)

- BRILLIANCE (Брилиянс)

- BYD (Бюд)

- CHANGAN (Чанган)

- CHERY (Чери)

- CHEVROLET (Шевроле)

- CHRYSLER (Крайслер)

- CITROEN (Ситроен)

- DATSUN (Датсун)

- DODGE (Додж)

- DONGFENG

- EVOLUTE

- EXEED

- FAW (Фав)

- FIAT (Фиат)

- FORD (Форд)

- GEELY (Джили)

- GREAT WALL (Грейт Вол)

- HAFEI (Хафей)

- HAIMA (Хайма)

- HAVAL (Хавал)

- HAWTAI (Хавтай)

- HONDA (Хонда)

- HYUNDAI (Хендай)

- ISUZU (Исузу)

- JEEP

- JETOUR

- KAIYI (Каи)

- KIA (Киа)

- LADA (Лада)

- LEXUS (Лексус)

- LIFAN (Лифан)

- MAZDA (Мазда)

- MERCEDES BENZ (Мерседес Бенц)

- MITSUBISHI (Мицубиси)

- NISSAN (Ниссан)

- OMODA

- OPEL (Опель)

- PEUGEOT (Пежо)

- RAVON (DAEWOO)

- RENAULT (Рено)

- SKODA (Шкода)

- SOLLERS

- SSANGYONG (Санг Йонг)

- SUBARU

- SUZUKI (Сузуки)

- TANK (Танк)

- TOYOTA (Тойота)

- VOLKSWAGEN (Фольксваген)

- ZAZ (ЗАЗ)

- ГАЗ (GAZ)

- ИЖ

- МОСКВИЧ 3

- ОКА

- ТАГАЗ (TAGAZ)

- УАЗ (UAZ)

-

Фаркопы

- ALFA ROMEO (Альфа Ромео)

- AUDI (Ауди)

- BMW (БМВ)

- CHERY (Чери)

- CHEVROLET (Шевроле)

- CHRYSLER (Крайслер)

- CITROEN (Ситроен)

- DACIA (Дация)

- DAEWOO (Дэу)

- DODGE (Додж)

- FIAT (Фиат)

- FORD (Форд)

- GEELY (Джили)

- GREAT WALL (Грейт Вол)

- HONDA (Хонда)

- HYUNDAI (Хендай)

- INFINITI (Инфинити)

- ISUZU

- IVECO

- JEEP (Джип)

- KHODRO (Ходро)

- KIA (Киа)

- LANCIA (Ланча)

- LAND ROVER (Ленд Ровер)

- LEXUS (Лексус)

- MAHINDRA

- MAZDA (Мазда)

- MERCEDES BENZ (Мерседес Бенц)

- MITSUBISHI (Мицубиси)

- NISSAN (Ниссан)

- OPEL (Опель)

- PEUGEOT (Пежо)

- RENAULT (Рено)

- SAAB (Сааб)

- SEAT (Сеат)

- SKODA (Шкода)

- SSANGYONG (Санг Йонг)

- SUBARU (Субару)

- SUZUKI (Сузуки)

- TATA (Тата)

- TOYOTA (Тойота)

- VOLKSWAGEN (Фольксваген)

- VOLVO (Вольво)

- ZX AUTO

- ВАЗ, ГАЗ, УАЗ, ИЖ

Популярные товары

-

Сумка Lux Boot в багажник большая черная

Эта сумка в багажник незаменимая вещь для содержания порядка в..

-

Сумка Lux Boot в багажник высокая бежевая

Эта сумка в багажник незаменимая вещь для содержания порядка в..

-

Новости

Полезное

-

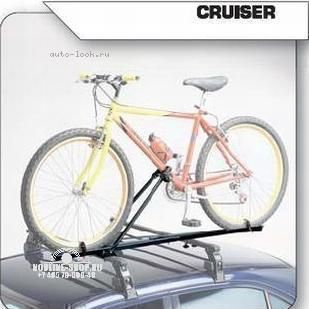

Крепление велосипеда Peruzzo Cruiser (1 вел).

Перейти к покупке! -

Комплект подкрылок TOYOTA LC150, 2017-, 4 элемента

Перейти к покупке!